Renters Insurance in and around Louisville

Welcome, home & apartment renters of Louisville!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Louisville

- New Albany

- Jeffersonville

- Shepherdsville

- Fairdale

- Pleasure Ridge Park

- Clarksville

- Shelbyville

- Mount Washington

- Bardstown

- Lyndon

- Sellersburg

- La Grange

- Jefferson County

- Bullitt County

- Shelby County

- Nelson County

- Hardin County

- Oldham County

- Meade County

- Spencer County

- Clark County

- Harrison County

- Floyd County

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - outdoor living space, price, size, apartment or townhome - getting the right insurance can be necessary in the event of the unpredictable.

Welcome, home & apartment renters of Louisville!

Renting a home? Insure what you own.

Why Renters In Louisville Choose State Farm

When the unexpected accident happens to your rented townhome or condo, usually it affects your personal belongings, such as a cooking set, a video game system or a TV. That's where your renters insurance comes in. State Farm agent Jeremy Graham is committed to helping you examine your needs so that you can protect yourself from the unexpected.

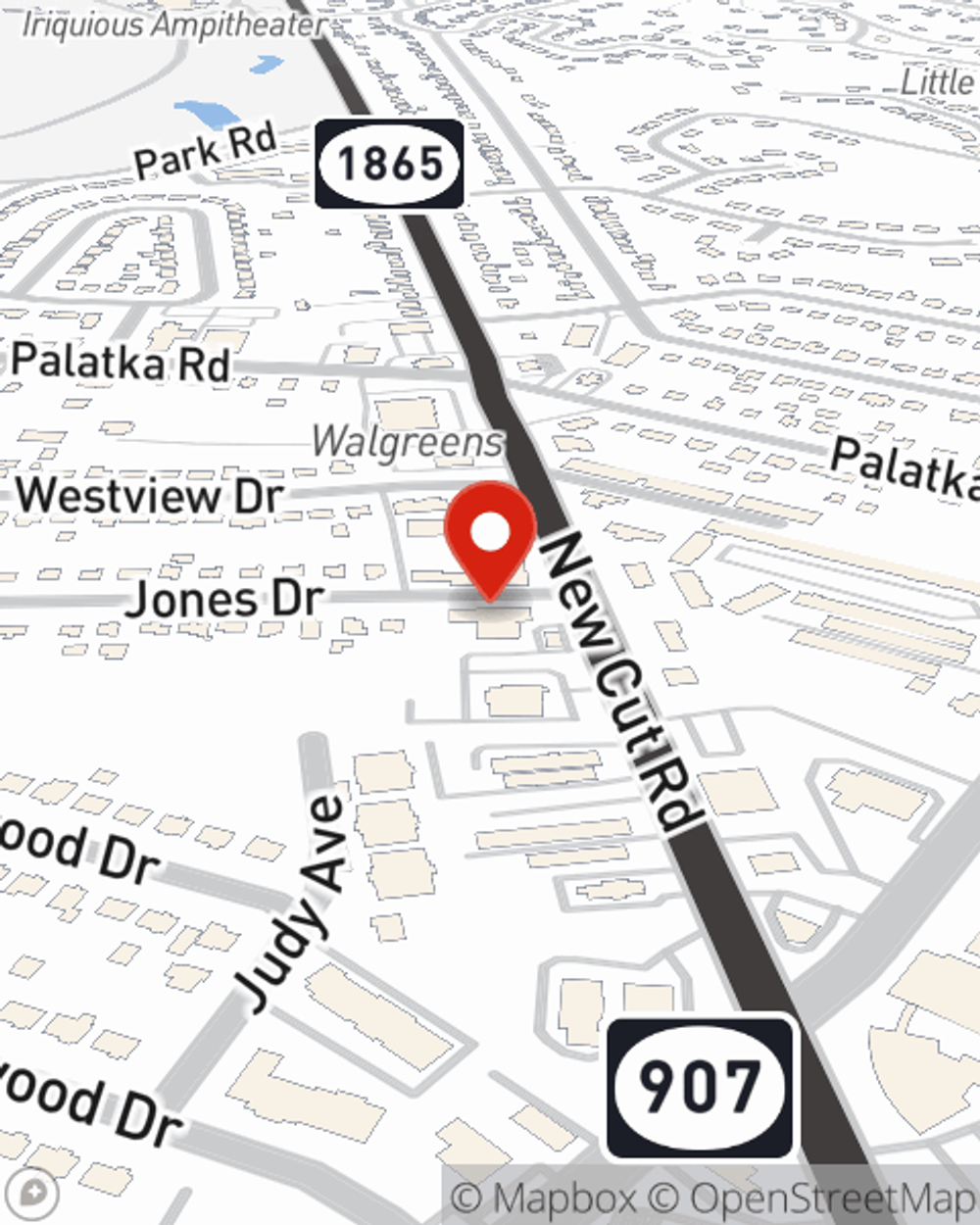

Contact State Farm Agent Jeremy Graham today to check out how the leading provider of renters insurance can protect items in your home here in Louisville, KY.

Have More Questions About Renters Insurance?

Call Jeremy at (502) 368-6529 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Jeremy Graham

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.